Blog

EfTEN Capital is the 2016 leader in investments in the Baltic commercial real estate market

In 2016, EfTEN Capital invested EUR 140 million in new commercial properties. While there is still one month to go until the end of the year, we have completed our investment activity for 2016. Here is a brief overview of the year. While 2015 saw us invest a total of EUR 110 million into five commercial buildings, then this year we made six investments with a total value of EUR 140 million.

More than one half of the investment volume constituted the purchase of the Domina shopping centre in Riga. The transaction value of Domina was EUR 74.5 million; the seller was KanAm Grund, who acquired the centre in 2006 from Pro Kapital for EUR 152 million. We will invest additional EUR 5 million in the reconstruction of Domina, where several new stores are to be opened in the area formerly occupied by Prisma, including a RIMI food store. Furthermore, EfTEN Real Estate Fund III acquired in sales and leaseback transaction three logistics centres in Tallinn, Riga and Vilnius, which are leased by the DSV Group. EfTEN Kinnisvarafond II AS acquired the Magistral shopping centre in Mustamäe, Tallinn, from Citycon. In the last transaction of the year, EfTEN Real Estate Fund III acquired the office building L3, in Vilnius, where the seller was E.L.L. Kinnisvara.

According to Colliers International, the total volume of commercial property investments in the Baltics this year will be EUR 1.17 billion, which gives EfTEN Capital a 12% market share and first place in terms of volume in the Baltics.

In terms of a wider market outlook, we are more pessimistic than many of our competitors. Specifically, we consider the yields of Baltic commercial real estate markets to be low, for example, compared to other capital cities in Central and Eastern Europe. The competitive advantage that has existed for years, where the returns of the Baltic commercial real estate market were up to 3-4% higher, no longer really apply.

This is a seller’s market, where the interest and actual capacity to invest exceeds the number of investment-worthy properties. In terms of new investments we are maintaining a conservative position, since we consider the overall price level of the market to be high.

Financial models of commercial property investments are built on the assumption that the rents increase in line with inflation. If after a period of several years we now have reason to expect inflation to increase in 2017, then the same prediction cannot be made for rent. New supply, currently under construction, will be added in each commercial property segment and in each capital of the Baltic states. Accordingly, the rent prices are moving sideways and the pressure is rather on increased vacancy and overall reduction of rent levels. Five years from now we will be able to retrospectively assess whether 2016 was the year when the interest rates were historically at their lowest-ever level and from thenceforth showed a slight increasing trend. The indications are there.

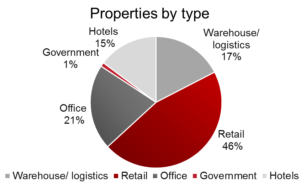

As at year’s end EfTEN Capital manages 46 commercial buildings with a market value of EUR 500 million and with more than 900 tenants. EfTEN Capital is the largest management company for commercial real estate in the Baltic states.